Many adults are now finding that not only are they raising their children, but they are also caring for their aging parents. This leads to numerous challenges as these individuals try to balance their work and home life. Individuals in this situation may find they want to bring their parents to live with them. How can this be done while allowing everyone their own personal space and independence? A Granny Flat may be the solution they have been searching for.

What Is a Granny Flat?

A granny flat is either an in-law suite within the home or a separate dwelling established on the same property as a person’s main residence. While the name implies it is for grandmothers, the unit can actually be used by anyone in need of a residence. Families may offer it to a nanny or other live-in help or a college student could rent the residence as opposed to living in a dorm with many other people. Most residences of this type fall into the tiny house category and many are fine with the limited space, as it is their own.

The Benefits of a Granny Flat

A granny flat, often called an accessory dwelling, is established on the same property as the main residence but gives all parties their privacy and own space. The children and parents are close by, so the adult isn’t pulled in different directions as often, and the inclusion of the grandparents is often a blessing also. The parents know they have someone available who loves and cares for their children as much as they do. This can be of great help when a parent is running late and needs someone to get the child off the bus or has a doctor’s appointment and the babysitter cancels at the last minute.

Individuals who are considering a Sacramento remodel or those who have an aging parent residing with them should consider this option. As the American population is aging and more seniors will need additional care, numerous families would benefit from the inclusion of a granny flat. It is a good investment due to the increase in seniors in the country who will be needing new housing and a great way to keep loved ones close. Consider adding a flat of this type on your property today. It’s a move you won’t regret.

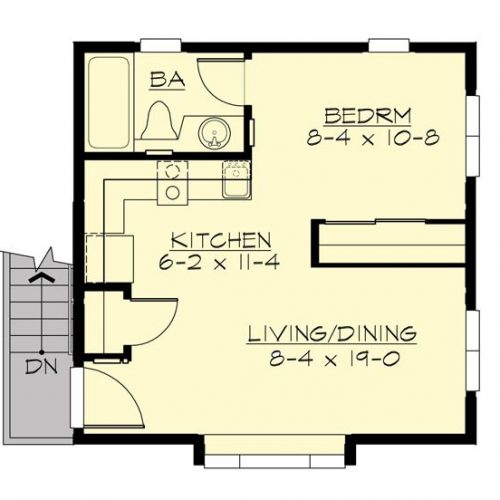

Here’s the Granny Flat I Want!

Check Sacramento Top 10 for a Remodeling Contractor that specializes in Granny Flats.

Frequently Asked Questions

Accessory Dwelling Units (ADU)

Accessory Dwelling Unit (ADU), Granny Flat, and Mother-in-Law Unit are essentially different terms used to describe the same concept: a smaller, secondary housing unit on the same property as a primary residence. The terms are often used interchangeably, but they can sometimes carry slightly different connotations based on regional usage or specific features. Here’s a brief explanation of each:

- Accessory Dwelling Unit (ADU): This is a general term that encompasses any secondary housing unit on a residential property. ADUs can be built in various ways, such as being attached to the main house (like an above-garage apartment), detached (a separate building), or a conversion of existing space (like a basement). They typically have their own kitchen, bathroom, and separate entrance.

- Granny Flat: This term is often used to refer to a type of ADU that is intended for use by aging parents, hence the name “granny”. The idea is to provide a living space that allows for independence while still being close to family for support. However, it is just another term for an ADU and does not have to be used exclusively by grandparents. It can also be detached or attached to the main house.

- Mother-in-Law Unit: This term is very similar to a Granny Flat and is another name for an ADU. It traditionally refers to a space that is separate from the main house and is used to provide privacy and independence for in-laws when they visit or live with the family.

In essence, the differences between these terms are minor and more about their usage in different contexts or regions. In practice, they all refer to a secondary housing unit on a property. The design, size, and specific features of these units can vary widely depending on local regulations, the property’s size, and the homeowner’s preferences.

Accessory Dwelling Units (ADUs) can add significant value to a property in California. On average, an ADU can add about $470 per square foot to the value of a property, though this amount can vary widely across the state. For instance, some ADUs in San Carlos have added more than $500,000 to a property’s value, and in Berkeley, some ADUs have increased a property’s value by over $600,000.

The size of an ADU is a major factor influencing its value. A studio ADU will generally be worth less than a one-bedroom ADU. The average size of a new ADU in California is 615 square feet, which makes the average value of an ADU approximately $468,630. This value would increase if your ADU were larger, say closer to 1,000 square feet.

The type of ADU also impacts the value it adds to your property. Detached ADUs typically carry the most value as they are separate spaces with a natural sound barrier. In some cases, a detached ADU can increase your property’s value by as much as 30%. However, attached, garage, and basement ADUs can also bring substantial value to your home, as they can function as living or rental spaces.

The value of your property can affect the value of your ADU. For example, an ADU on a property worth $600,000 will have a higher value than an ADU on a property worth $375,000. The location of your property, such as its proximity to parks and shopping centers, can also increase the value of your ADU.

It’s important to note that building an ADU involves obtaining proper city and county permits, which can cost anywhere from six to nine percent of your construction costs, depending on the complexity of the ADU project, the size of the unit, and the value of the construction.

Renting out your ADU can increase its return on investment and the amount of income generated from your property. For instance, ADU owners in the San Francisco Bay Area charge their tenants a median rent of $2,200 per month. Some cities restrict new ADUs to longer than 30-day rentals, but you can rent out your unit as a vacation rental. In San Francisco, ADU owners are renting their units to Airbnb users for an average of $191 per night.

However, the added value can vary depending on the specifics of the property and the ADU. For instance, a study conducted by Revival Homes, a Los Angeles-based firm, found that the typical ADU adds about 24% (around $250,000) to the sale price of a single-family home in L.A. County, with values ranging from 18% to 35% depending on the ADU’s size. Another appraiser based in San Gabriel found that ADUs typically add 10% to 20% to a property’s value, with the location of the property playing a significant role in the ADU’s worth. Therefore, it is advisable to consider the specifics of your property and local market conditions when estimating the value an ADU could add.

In California, an Accessory Dwelling Unit (ADU) can increase your property taxes, but not by reassessing the entire value of your property. Instead, a “blended assessment” is conducted, in which the county tax assessor estimates the value of the ADU, likely based on its construction cost, and adds this to the current assessed value of your property. This results in a new assessed property value. The value of the primary home is not reassessed.

For example, if you complete an ADU project that cost $200,000 to build, and your combined city-county property tax rate is 1%, you’d pay an additional $2,000 per year in property taxes going forward. This amount would be added to the property taxes you were already paying on your primary home, but the tax amount on the primary home would not change, because its assessed value would remain the same.

If you have lived in your home for many years and currently pay low property taxes, the construction of an ADU will allow you to maintain your low property taxes going forward.

There are several ways to finance a granny flat, also known as an Accessory Dwelling Unit (ADU), in California:

- Home Equity Loan or Line of Credit (HELOC): If you have built up significant equity in your home, you may be able to use a home equity loan or a home equity line of credit to finance the construction of an ADU. These types of loans use your home as collateral and allow you to borrow a lump sum of money that you repay over a fixed period of time.

- Cash-Out Refinance: This involves refinancing your mortgage and taking out a larger loan than what you owe on your home. The difference between the new loan and the amount you owe on your home is given to you in cash, which you can use to finance your ADU.

- Construction Loan: These are short-term loans that cover the cost of construction. Once the ADU is built, you would typically refinance this into a more traditional mortgage.

- Personal Loan: If the cost of the ADU is not very high, or if you have excellent credit and a high income, you may be able to cover the cost with a personal loan.

- Savings: If you have significant savings, you may be able to finance the ADU without borrowing.

- Government Programs and Incentives: Some local and state governments offer financial incentives, such as low-interest loans or grants, for homeowners who build ADUs. Be sure to research whether any such programs are available in your area.

- Renovation Mortgage: Some lenders offer renovation mortgages, which allow you to finance both the purchase of a home and the cost of improvements, like an ADU, in a single loan.

It’s important to note that all of these options involve varying degrees of risk and cost. You should carefully consider your own financial situation and consult with a financial advisor or mortgage professional before deciding on the best way to finance an ADU.

No, you cannot legally build an Accessory Dwelling Unit (ADU) without a permit in California. The process of building an ADU requires obtaining the proper city and county permits before construction begins. These permits ensure that the ADU complies with local zoning, building codes, and safety regulations.

The specifics of these permits can vary widely by city and county. For example, in San Francisco, ADU permits can cost anywhere from six to nine percent of your construction costs. The costs are typically based on the complexity of the ADU project, the size of the unit, and the value of the construction1.

Building an ADU without the necessary permits can lead to serious consequences, including fines, legal actions, and the potential requirement to demolish the un-permitted construction. Therefore, it is crucial to follow all local regulations and obtain all necessary permits before starting the construction of an ADU.

Yes, Sacramento is actively encouraging the building of Accessory Dwelling Units (ADUs). The city has developed Permit Ready ADU Plans for detached ADUs that can be used by any resident, meeting all the 2022 Residential Building Code requirements. These free Permit Ready Plans are all-electric, and applicants only need to submit a site plan to show where on the property the ADU will be placed.

In addition, Sacramento has been eager to participate in the California Accessory Dwelling Units (ADUs) Program, which aims to create more affordable housing by promoting the construction of ADUs. This program provides funds to homeowners who are interested in building an ADU and making it available for rent. Homeowners were encouraged to apply for this program before April 1, 2023.

The California Housing Finance Agency had an Accessory Dwelling Unit (ADU) Grant Program that offered up to $40,000 towards pre-development and non-recurring closing costs associated with the construction of an ADU. This covered costs such as site preparation, architectural designs, permits, soil tests, impact fees, property surveys, and energy reports. However, as of March 1, 2023, all funds for this grant program were fully reserved. The agency is keeping the grant program information available to help borrowers and lenders as they continue to process grants in their pipeline1.

Yes, Sacramento has released permit-ready building plans for detached accessory dwelling units (ADUs). These plans can be used by any resident and have been uploaded to Symbium Build to assist with site planning. The free permit-ready plans comply with all the 2022 Residential Building Code requirements and are all-electric. Applicants are required to submit a site plan showing where on the property the ADU will be situated. It’s important to note that modifications to these permit-ready plans are not allowed.

Yes, you can generally build an Accessory Dwelling Unit (ADU) on your property in Sacramento. However, whether or not you can build an ADU on your specific property depends on the zoning of your lot and other regulations. You will need to look up the zoning information for your property and determine if ADUs are allowed.

Under state law, a homeowner in Sacramento may construct up to three dwelling units in addition to the primary dwelling unit. These units may consist of one attached or converted ADU, one detached ADU, and one junior ADU. Additionally, the owners of multi-unit dwellings may convert up to 25% of the portions of the existing multi-unit dwellings that are not used as livable space.

The City of Sacramento’s ADU zoning requirements include considerations for the size, setbacks, and separation of the units. For example, a detached ADU can have a maximum size of 1,200 square feet in total, and must comply with the minimum front yard setback of the property’s zone. A 3-foot minimum interior side and rear yard setbacks are required if the entire ADU is less than 60 feet from the front property line.

ADUs are also allowed within the 30 historic districts in Sacramento. If your property is a historic landmark or within a historic district, your ADU will need to comply with the City’s Historic District Plans and Design Guidelines and the Secretary of the Interior’s Standards. ADUs on landmark properties will need to be reviewed by the Preservation Director.

There’s a free tool, Symbium Build, that can instantly determine if an ADU is allowed on your property and explore different locations and designs for your ADU1. I recommend checking this out as a first step in your planning process.

The cost to build an ADU in Sacramento can vary widely depending on various factors such as on-site conditions, construction style, materials, and finishes. A detailed cost estimate will typically require consultation with a contractor. As a rough guide, about 80% of the total project budget can be expected to go towards construction (materials and labor), with the remaining 20% covering consulting, design, and permitting fees. Additionally, the City of Sacramento collects certain fees for the review of each ADU application, including a Planning Application fee (flat rate), Building Plan Review fee (variable), and other miscellaneous fees that are generally determined by the valuation of the project1.